Finance

January 1, CEO’s Grim Prediction Becomes Reality as Company Defaults on $212 Million Loan

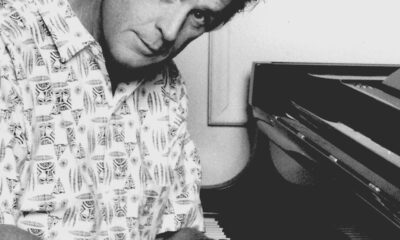

Starwood Capital Group’s CEO, Barry Sternlicht, warned back in November about the damaging consequences of rising Federal Reserve interest rates on the U.S. economy.

His warning seems prescient now as his company recently defaulted on a $212.5 million mortgage for an office tower in Atlanta, proving the dire predictions accurate.

Federal Reserve has been persistently increasing interest rates to counteract inflation, making loans progressively more expensive.

This steady rise in rates has adversely impacted both housing and corporate sectors.

Notably, last month, the Federal Reserve didn’t raise the key interest rate for the first time in the past 15 months.

However, according to Fed Chair Jerome Powell, this breather could be ephemeral, with at least two more hikes anticipated before the year concludes.

The swelling interest rates have compounded the difficulty of housing purchases in an already competitive market.

Average rates are nearing 7 percent, a substantial leap from the 3 percent average mortgage rate in January 2022.

Sternlicht’s Starwood Capital Group couldn’t dodge the fallout from these skyrocketing rates. Unable to refinance or pay off its loan, the company defaulted on its mortgage for Tower Place 100 in Atlanta, Georgia.

Reportedly, lenders have now appointed legal counsel to negotiate an agreement.

In a previous interview with CNBC, Sternlicht expressed his criticism of the Fed’s inflation combat strategy, stating, “It’s not sustainable,” he said.

“What they want to do is clearly suicide.”

Sternlicht further predicted that the looming repercussions of the rate hikes would be preceded by companies slashing their 2023 budgets in anticipation of a recession.

Economists are increasingly warning of a commercial real estate collapse, with values for office, retail, and apartment buildings already dropping by 11 percent and projected to plummet as much as 40 percent, according to Nick Gerli, CEO of Reventure Consulting.

Bottom Line

Starwood Capital Group is not alone in its plight. Several other corporate landlords are also defaulting, particularly for office buildings, due to weakening demand in the wake of the work-from-home trend during the COVID-19 pandemic.

Sternlicht’s forewarning rings even more ominously true in the current scenario.

The sustained rate hikes will undoubtedly impede the economy’s growth, “It cannot do anything other than that,” Sternlicht had cautioned last November.

Today, his predictions serve as a distressing reality for corporations like his own.

As our loyal readers, we encourage you to share your thoughts and opinions on this issue. Let your voice be heard and join the discussion below.

-

Entertainment4 months ago

Entertainment4 months ago‘He’s A Pr*ck And F*cking Hates Republicans’: Megyn Kelly Goes Off on Don Lemon

-

Entertainment9 months ago

Entertainment9 months agoWhoopi Goldberg’s “Wildly Inappropriate” Commentary Forces “The View” into Unscheduled Commercial Break

-

Entertainment8 months ago

Entertainment8 months agoLate Night Host is Getting Canceled After Staffers Speak Out

-

Entertainment3 months ago

Entertainment3 months agoBeach Boys Founder Brian Wilson Announces Tragic News

-

Featured8 months ago

Featured8 months agoUS Advises Citizens to Leave This Country ASAP

-

Entertainment2 months ago

Entertainment2 months agoComedy Mourns Legend Richard Lewis: A Heartfelt Farewell

-

Featured7 months ago

Featured7 months agoBenghazi Hero: Hillary Clinton is “One of the Most Disgusting Humans on Earth”

-

Latest News2 months ago

Latest News2 months agoSupreme Court Gift: Trump’s Trial Delayed, Election Interference Allegations Linger

Ironmike

July 25, 2023 at 6:37 pm

FJB!!!

Ephraim Ponce

July 25, 2023 at 9:16 pm

Inflation is a huge problem. But the unrelenting rate increases is also a huge problem. I think the Fed needs to re-evaluate instead of knee jerk raising rates at every session (but 1).