Featured

January 1, 8 Celebrities Charged in Widespread Financial Scheme

ON THIS DAY IN HISTORY…

1989: The Exxon Valdez oil tanker spills 11 million gallons of oil into Prince William Sound in Alaska, creating what was — at the time — the largest oil spill in U.S. history.

Eight celebrities are facing federal fraud charges stemming from a widespread market manipulation scheme, the Securities and Exchange Commission (SEC) announced this week.

On Wednesday, the SEC announced “charges against crypto asset entrepreneur Justin Sun and three of his wholly-owned companies, Tron Foundation Limited, BitTorrent Foundation Ltd., and Rainberry Inc. (formerly BitTorrent), for the unregistered offer and sale of crypto asset securities Tronix (TRX) and BitTorrent (BTT).”

The SEC accuses Sun and his companies of violating Section 5 of the Securities Act, in party by “orchestrating a scheme to pay celebrities to tout TRX and BTT without disclosing their compensation.”

The commission charged the celebrities — including actress Lindsay Lohan, YouTuber Jake Paul, and rapper Soulja Boy (real name DeAndre Cortez Way) — for “illegally touting TRX and/or BTT without disclosing that they were compensated for doing so and the amount of their compensation.”

Also facing charges are musical artists Austin Mahone, Miles Parks McCollum (Lil Yachty), Shaffer Smith (Ne-Yo), Aliaune Thiam (Akon), and adult film star Michele Mason (Kendra Lust).

The aforementioned celebrities promoted TRX and BTT on Twitter without disclosing that they had been paid for their tweets, SEC Chair Gary Gensler said in a press release.

“This case demonstrates again the high risk investors face when crypto asset securities are offered and sold without proper disclosure,” Gensler said. Sun and his companies “targeted U.S. investors in their unregistered offers and sales, generating millions in illegal proceeds at the expense of investors.”

“Sun further induced investors to purchase TRX and BTT by orchestrating a promotional campaign in which he and his celebrity promoters hid the fact that the celebrities were paid for their tweets,” he added.

Sun’s illegal actions generated proceeds of $31 million, the complaint alleges.

Gurbir Grewal, Director of the SEC’s Division of Enforcement, said the scheme employed an “age-old playbook to mislead and harm investors” and “is the very conduct that the federal securities laws were designed to protect against.”

“Sun and others used an age-old playbook to mislead and harm investors by first offering securities without complying with registration and disclosure requirements and then manipulating the market for those very securities,” Grewal said.

“At the same time, Sun paid celebrities with millions of social media followers to tout the unregistered offerings, while specifically directing that they not disclose their compensation.”

Six of the celebrities — excluding Soulja Boy and musician Austin Mahone — “agreed to pay a total of more than $400,000 in disgorgement, interest, and penalties to settle the charges, without admitting or denying the SEC’s findings.”

Sources: The Daily Wire | SEC

-

Entertainment2 years ago

Entertainment2 years agoWhoopi Goldberg’s “Wildly Inappropriate” Commentary Forces “The View” into Unscheduled Commercial Break

-

Entertainment1 year ago

Entertainment1 year ago‘He’s A Pr*ck And F*cking Hates Republicans’: Megyn Kelly Goes Off on Don Lemon

-

Featured2 years ago

Featured2 years agoUS Advises Citizens to Leave This Country ASAP

-

Featured2 years ago

Featured2 years agoBenghazi Hero: Hillary Clinton is “One of the Most Disgusting Humans on Earth”

-

Entertainment1 year ago

Entertainment1 year agoComedy Mourns Legend Richard Lewis: A Heartfelt Farewell

-

Featured2 years ago

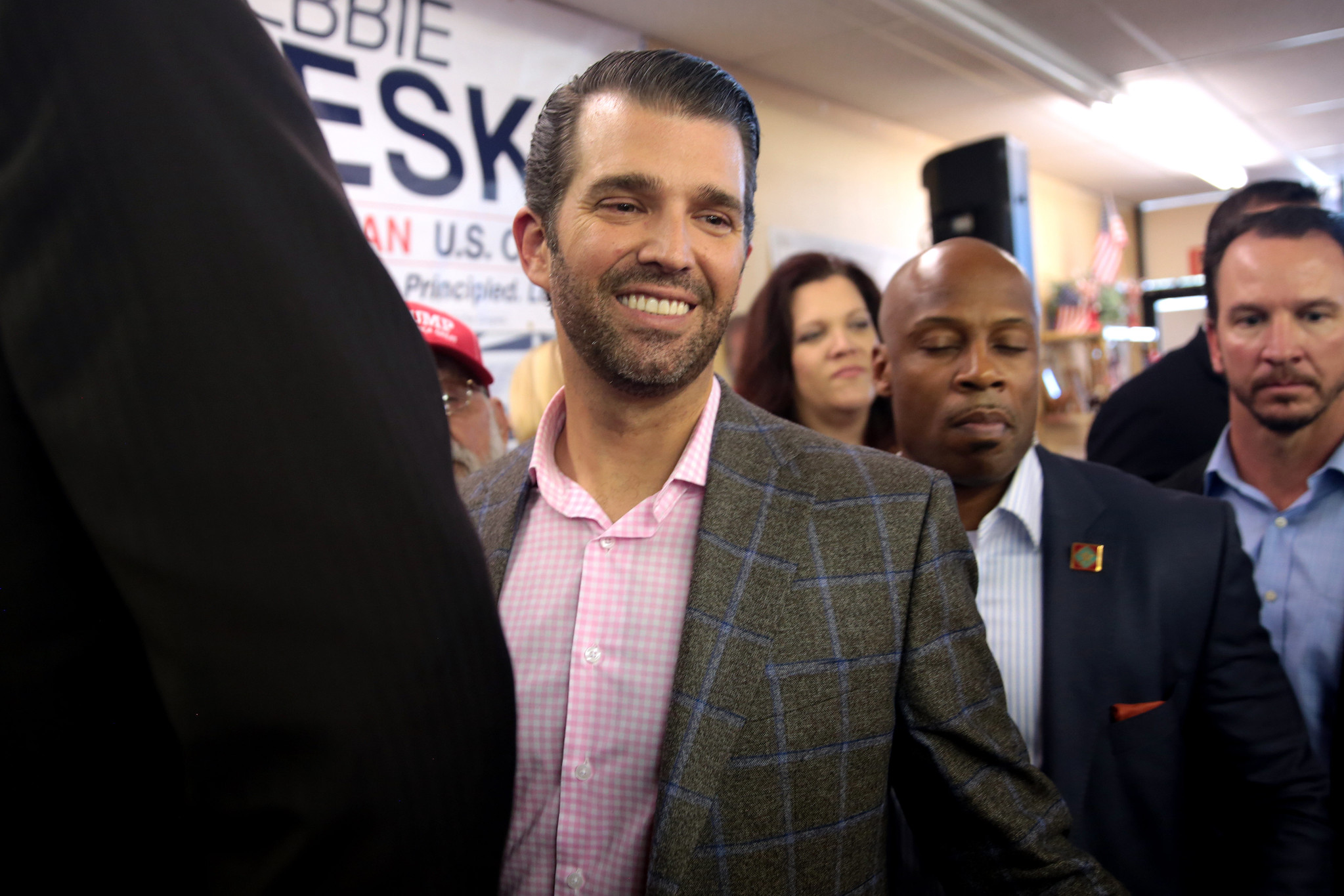

Featured2 years agoFox News Calls Security on Donald Trump Jr. at GOP Debate [Video]

-

Latest News1 year ago

Latest News1 year agoNude Woman Wields Spiked Club in Daylight Venice Beach Brawl

-

Latest News1 year ago

Latest News1 year agoSupreme Court Gift: Trump’s Trial Delayed, Election Interference Allegations Linger