Hey there, folks! I’ve got some big news for you about the economy, and it’s looking pretty good right now. In April, the inflation rate was...

President Trump is not happy with Federal Reserve Chairman Jerome Powell. He thinks Powell doesn’t make smart choices about interest rates. Trump said Powell doesn’t have...

Hey there, folks! Looks like people are getting worried our hard-earned dollars won’t stretch as far next year. The University of Michigan checked in on what...

Inflation dropped to 3.1% for the year ending in November, according to the Bureau of Labor Statistics. This decline was largely driven by energy prices, as...

Georgia has entered a state of emergency, and it’s not due to a natural disaster. Governor Brian Kemp announced this state of emergency in direct response...

Recent moves by the Biden administration to bolster food stamp benefits by $1 trillion might be tied to a substantial 15% surge in grocery prices, a...

ON THIS DAY IN HISTORY…1605: Gunpowder Plot – Catholic conspirator Guy Fawkes attempts to blow up King James I and the British Parliament. Plot discovered, Guy Fawkes caught, tortured, and later...

ON THIS DAY IN HISTORY…1962: Black Saturday during the Cuban Missile Crisis – An American spy plane is shot down over Cuba and the navy drops warning depth...

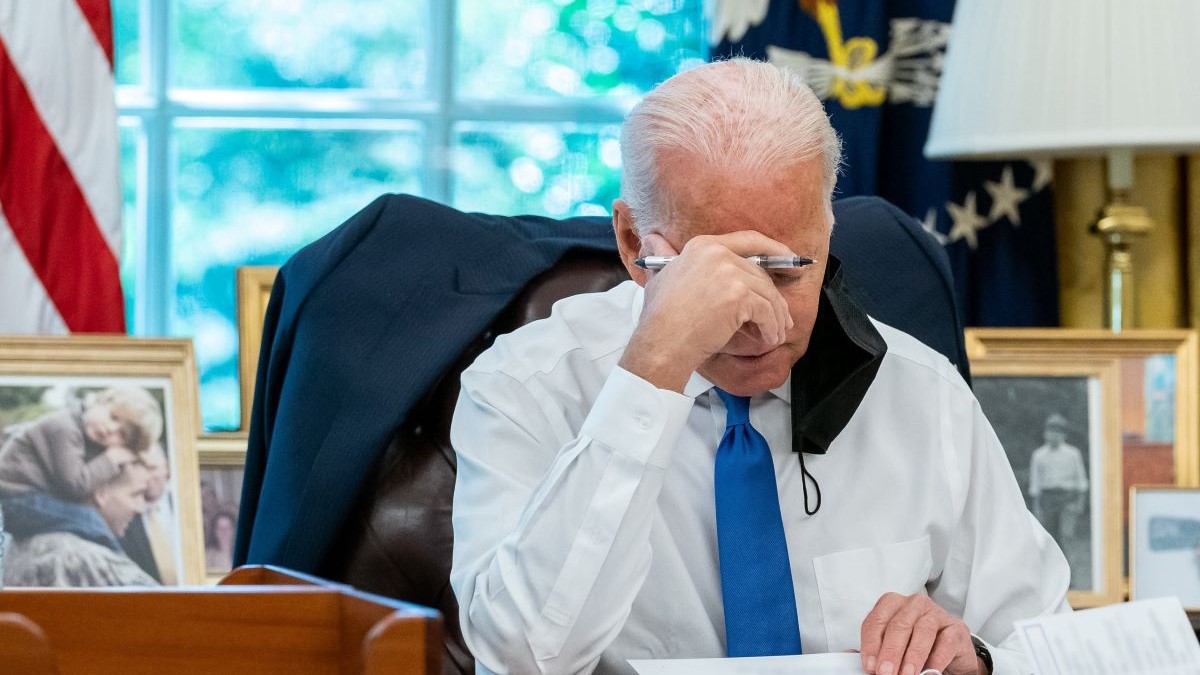

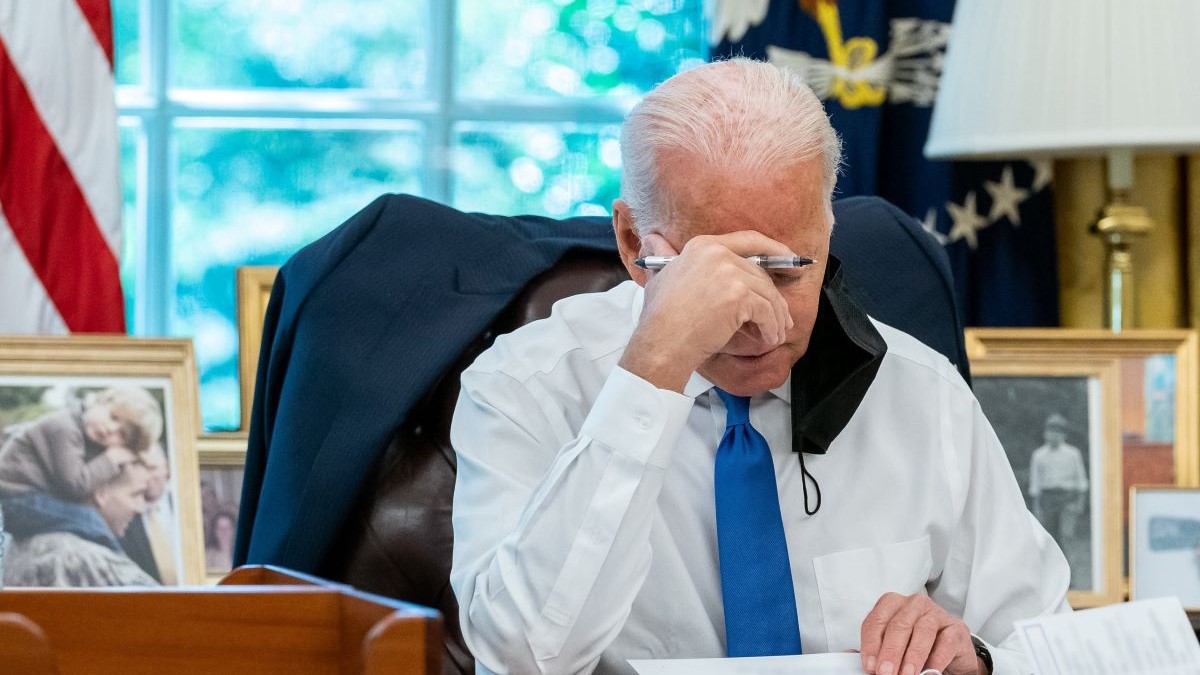

President Joe Biden snapped at a Fox News reporter who asked him which issue was his top priority: abortion rights or inflation. As Biden was wrapping...

The Social Security Administration is set to announce its largest cost-of-living adjustment (COLA) in more than 40 years on Thursday, which could make a big difference...