Finance

January 1, IRS Paying Interest to People with Delayed Tax Refunds

The Internal Revenue Service has announced that it will start paying 5 percent in guaranteed interest to individuals with delayed tax returns in July.

The agency will also pay 4 percent interest on delayed corporate tax returns, 5 percent on underpayments on tax returns, and 7 percent for “large corporate underpayments.”

Law allots the IRS 45 days to process a tax refund.

“The IRS is sitting on 13 million unprocessed tax returns and over 26 million tax returns that are waiting needing further IRS action,” Rep. Tom Rice (R-S.C.) said during a House subcommittee hearing last week.

“At the same time, IRS phone service levels are near all-time lows, making it nearly impossible to reach an IRS agent for help with tax or audit matters.”

According to a Government Accountability Office (GAO) report published last month, the IRS has paid out nearly $14 billion in delayed refund interest over the last seven fiscal years.

Source:

IRS to pay 5 percent interest to individuals with delayed tax refunds

-

Entertainment2 years ago

Entertainment2 years agoWhoopi Goldberg’s “Wildly Inappropriate” Commentary Forces “The View” into Unscheduled Commercial Break

-

Entertainment2 years ago

Entertainment2 years ago‘He’s A Pr*ck And F*cking Hates Republicans’: Megyn Kelly Goes Off on Don Lemon

-

Featured2 years ago

Featured2 years agoUS Advises Citizens to Leave This Country ASAP

-

Featured2 years ago

Featured2 years agoBenghazi Hero: Hillary Clinton is “One of the Most Disgusting Humans on Earth”

-

Entertainment2 years ago

Entertainment2 years agoComedy Mourns Legend Richard Lewis: A Heartfelt Farewell

-

Featured2 years ago

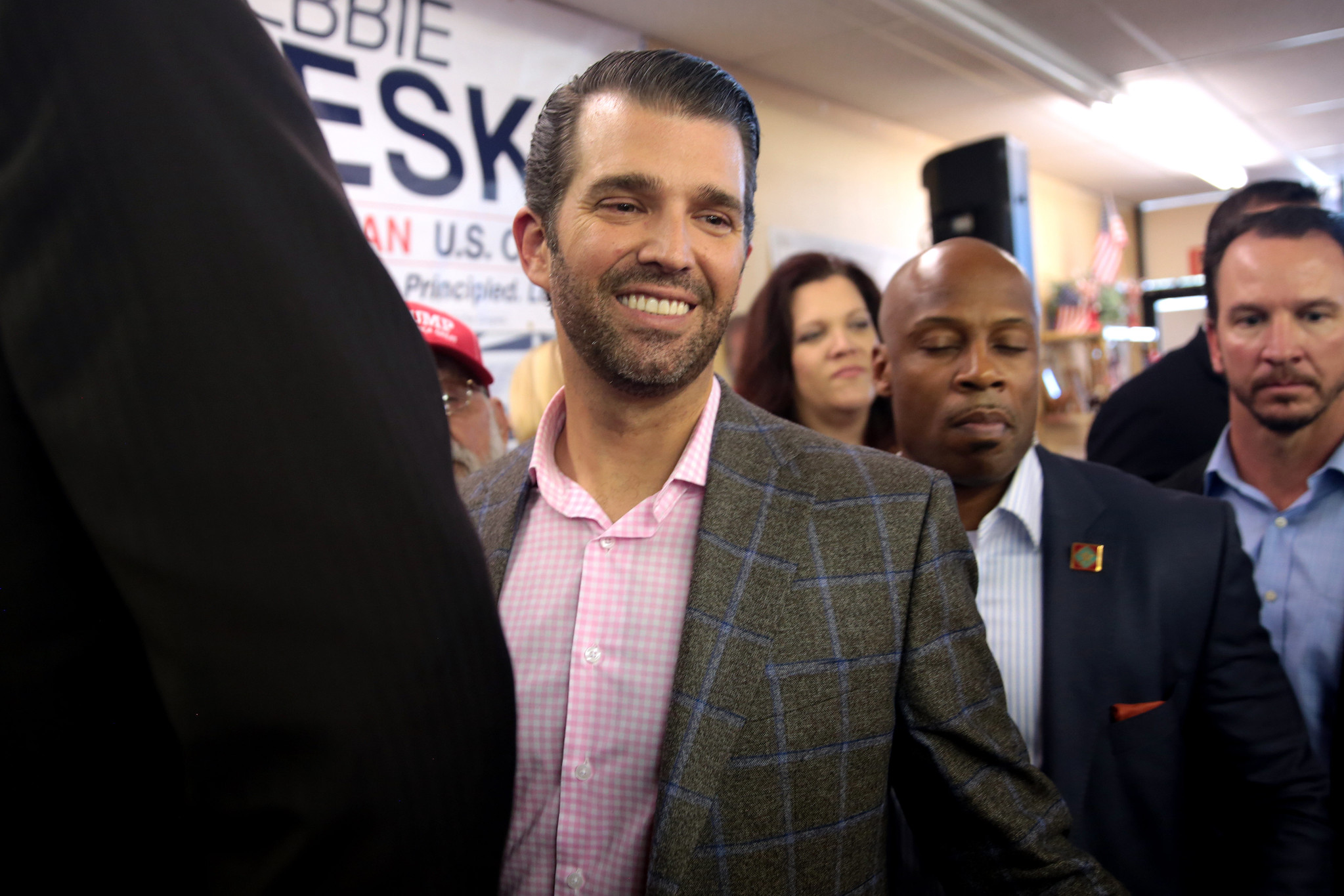

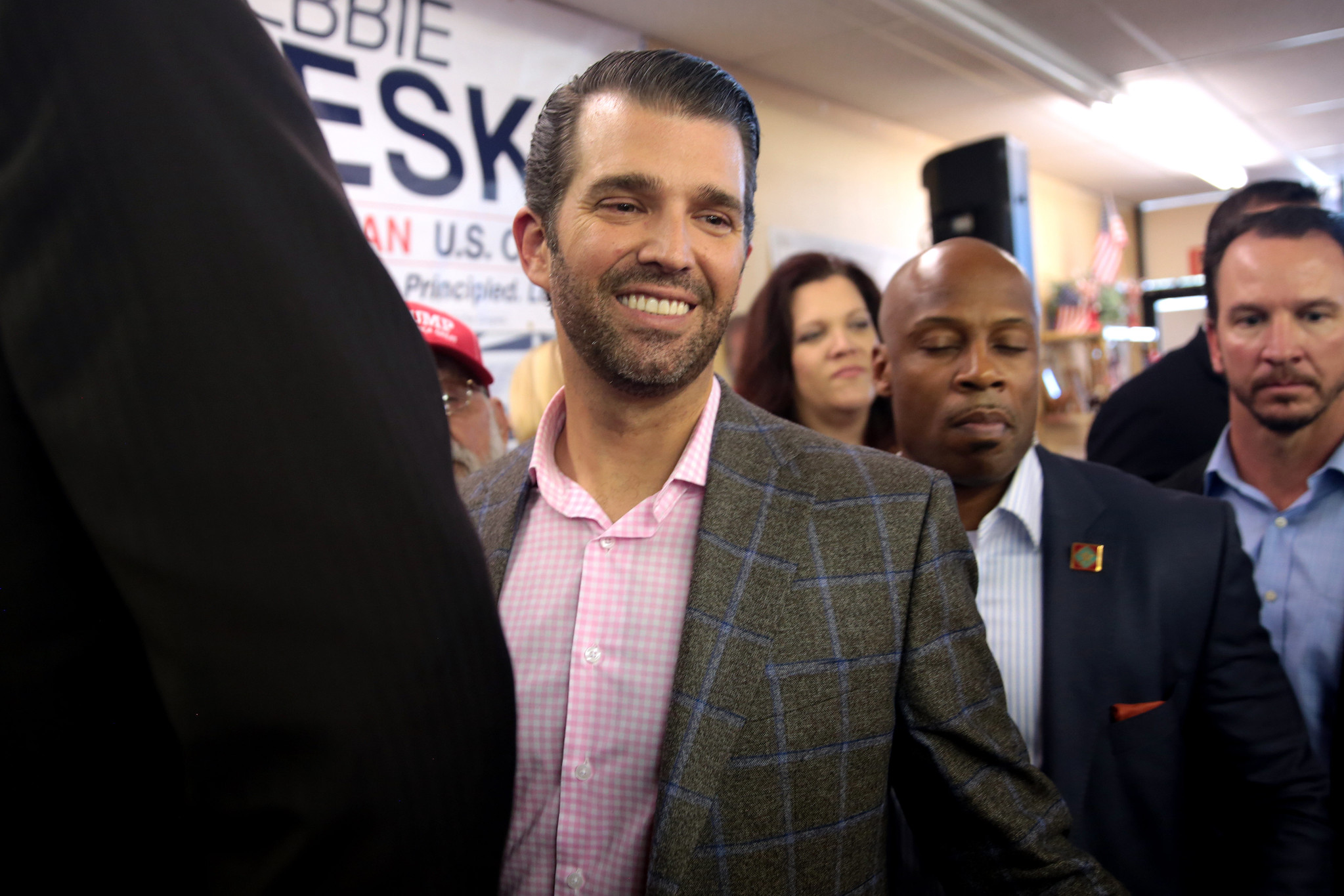

Featured2 years agoFox News Calls Security on Donald Trump Jr. at GOP Debate [Video]

-

Latest News2 years ago

Latest News2 years agoSupreme Court Gift: Trump’s Trial Delayed, Election Interference Allegations Linger

-

Latest News2 years ago

Latest News2 years agoNude Woman Wields Spiked Club in Daylight Venice Beach Brawl