Finance

January 1, Federal Reserve’s New Plan Might Cause a Recession

Federal Reserve members are trying to decide how quickly to reduce the central bank’s portfolio — without triggering a recession.

The Federal Reserve’s asset balance is nearly $9 trillion, most of which are securitized holdings of government debt and mortgages. CNBC reports that most of the Fed’s holdings were purchased to calm investors during the subprime mortgage crisis in 2008 and 2020′s pandemic.

“What’s happened is the balance sheet has become more of a tool of policy.” said Roger Ferguson, former vice chairman of the Federal Reserve Board of Governors. “The Federal Reserve is using its balance sheet to drive better outcomes in history.”

Historically, the central bank has used its lending power as a last resort to add liquidity to markets during distressing times. When the central bank buys bonds, it can push investors toward riskier assets. The Fed’s policies have boosted U.S. equities despite tough economic conditions for small businesses and average workers.

“If they apply too much grease too frequently, there are concerns that the overall machinery becomes risk-seeking and fragile in alternative ways,” said Kathryn Judge, a professor at Columbia Law.

Experts say that the Fed’s choice to raise interest rates in 2022 then quickly reduce the balance sheet could trigger a recession as riskier assets are repriced.

Source:

-

Entertainment2 years ago

Entertainment2 years agoWhoopi Goldberg’s “Wildly Inappropriate” Commentary Forces “The View” into Unscheduled Commercial Break

-

Entertainment1 year ago

Entertainment1 year ago‘He’s A Pr*ck And F*cking Hates Republicans’: Megyn Kelly Goes Off on Don Lemon

-

Featured2 years ago

Featured2 years agoUS Advises Citizens to Leave This Country ASAP

-

Featured2 years ago

Featured2 years agoBenghazi Hero: Hillary Clinton is “One of the Most Disgusting Humans on Earth”

-

Entertainment1 year ago

Entertainment1 year agoComedy Mourns Legend Richard Lewis: A Heartfelt Farewell

-

Featured2 years ago

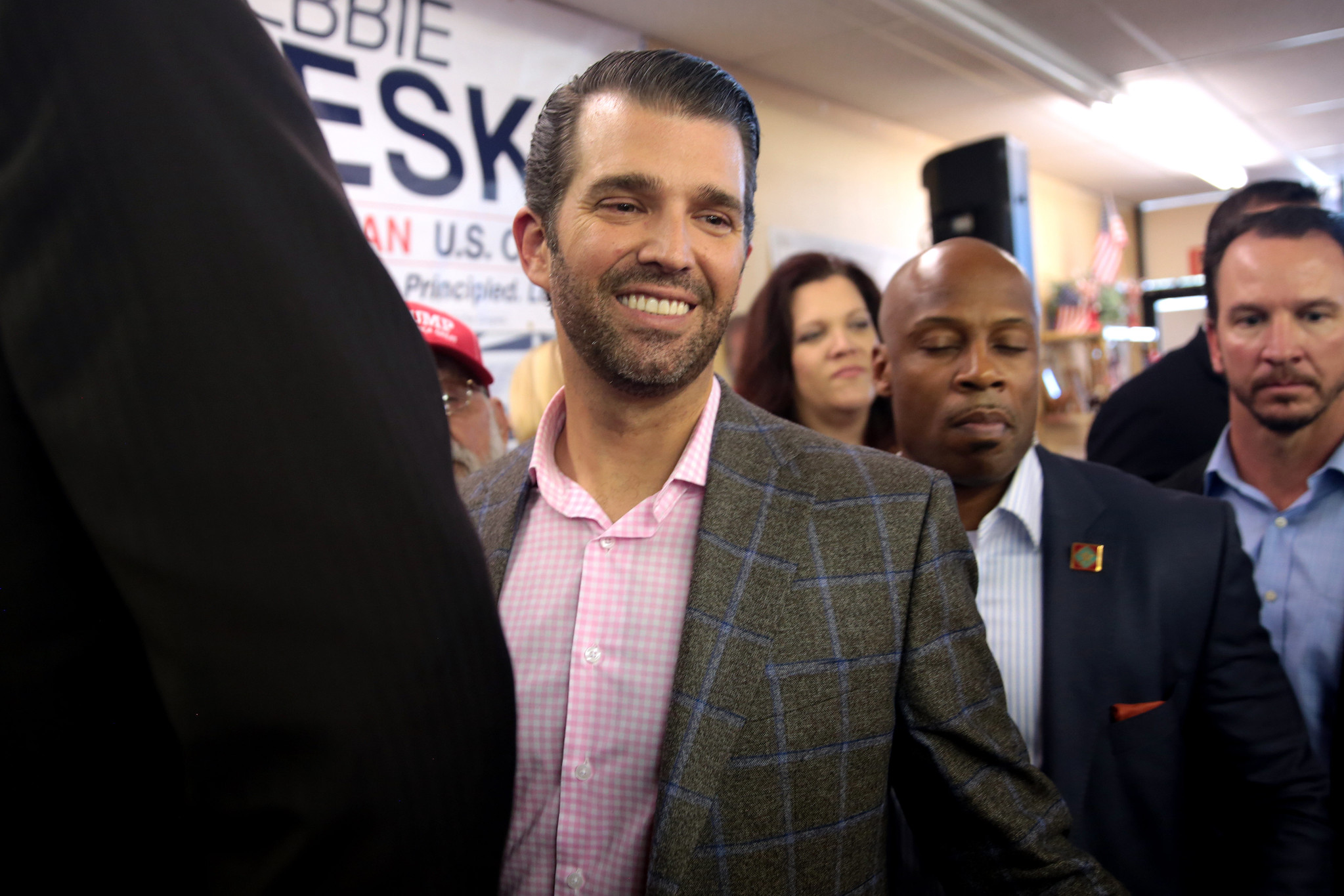

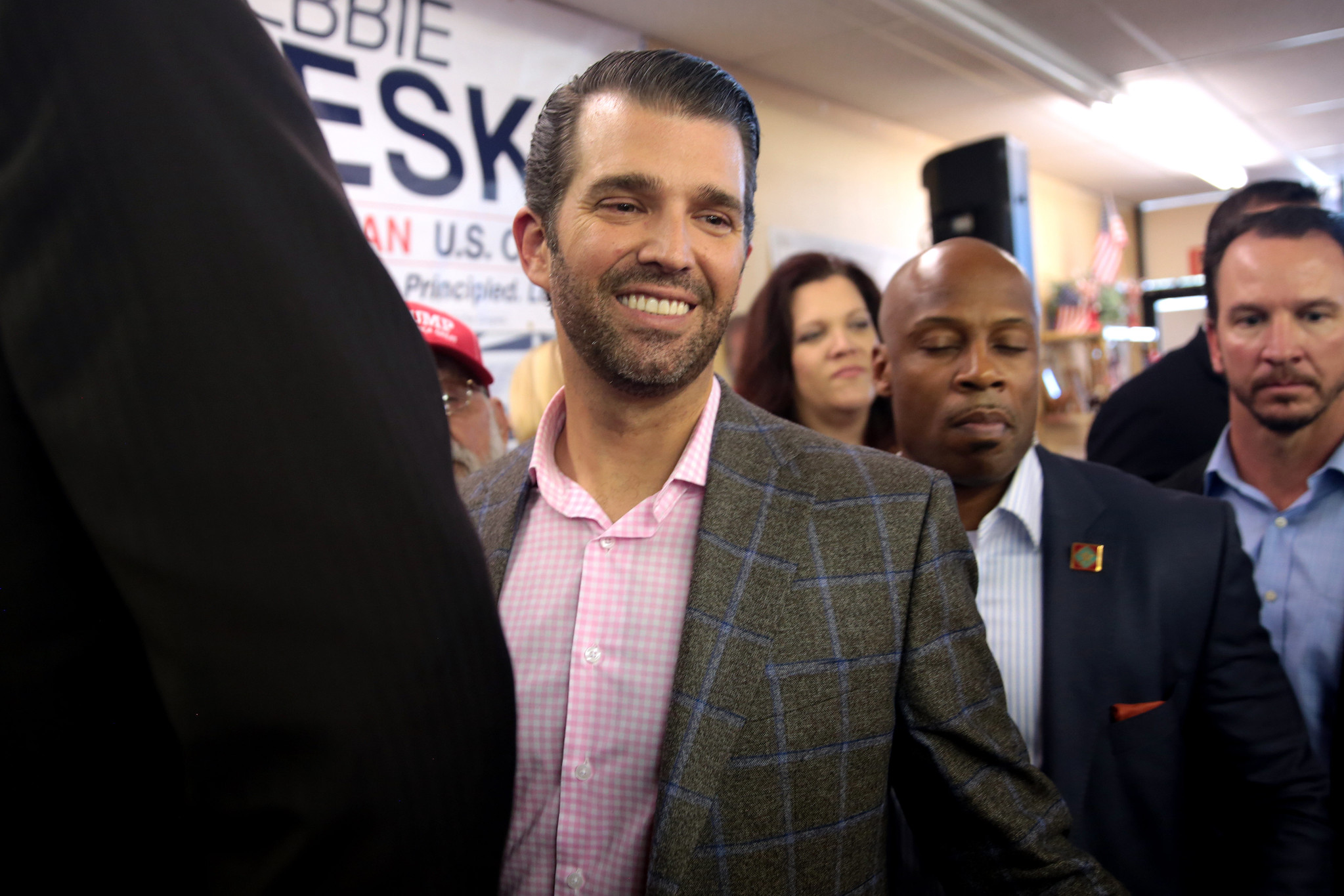

Featured2 years agoFox News Calls Security on Donald Trump Jr. at GOP Debate [Video]

-

Latest News1 year ago

Latest News1 year agoNude Woman Wields Spiked Club in Daylight Venice Beach Brawl

-

Latest News1 year ago

Latest News1 year agoSupreme Court Gift: Trump’s Trial Delayed, Election Interference Allegations Linger