Featured

January 1, Report: wealthiest Americans only paid a single-digit tax rate

According to a new White House report, the 400 wealthiest American families paid an average 8.2 percent tax rate on $1.8 trillion of income between 2010 and 2018.

“Two factors that contribute to this low estimated tax rate include low tax rates on the capital gains and dividends that are taxed, and wealthy families’ ability to permanently avoid paying tax on investment gains that are excluded from taxable income,” the analysis said.

The report, authored by economists from the White House Council of Economic Advisers and the Office of Management and Budget, is based on IRS statistics, the Federal Reserve’s Survey of Consumer Finances, and Forbes magazine estimates.

Finance Committee Chairman Ron Wyden (D-OR) said, “the White House’s new report is shocking but not surprising.”

The information comes as President Joe Biden aims to address the tax rate disparities through proposals to raise the top capital gains rate and end the “stepped-up basis” tax preference that benefits heirs.

Source:

White House: 400 wealthiest families paid average tax rate of 8.2 percent

-

Entertainment2 years ago

Entertainment2 years agoWhoopi Goldberg’s “Wildly Inappropriate” Commentary Forces “The View” into Unscheduled Commercial Break

-

Entertainment1 year ago

Entertainment1 year ago‘He’s A Pr*ck And F*cking Hates Republicans’: Megyn Kelly Goes Off on Don Lemon

-

Featured2 years ago

Featured2 years agoUS Advises Citizens to Leave This Country ASAP

-

Featured2 years ago

Featured2 years agoBenghazi Hero: Hillary Clinton is “One of the Most Disgusting Humans on Earth”

-

Entertainment1 year ago

Entertainment1 year agoComedy Mourns Legend Richard Lewis: A Heartfelt Farewell

-

Featured2 years ago

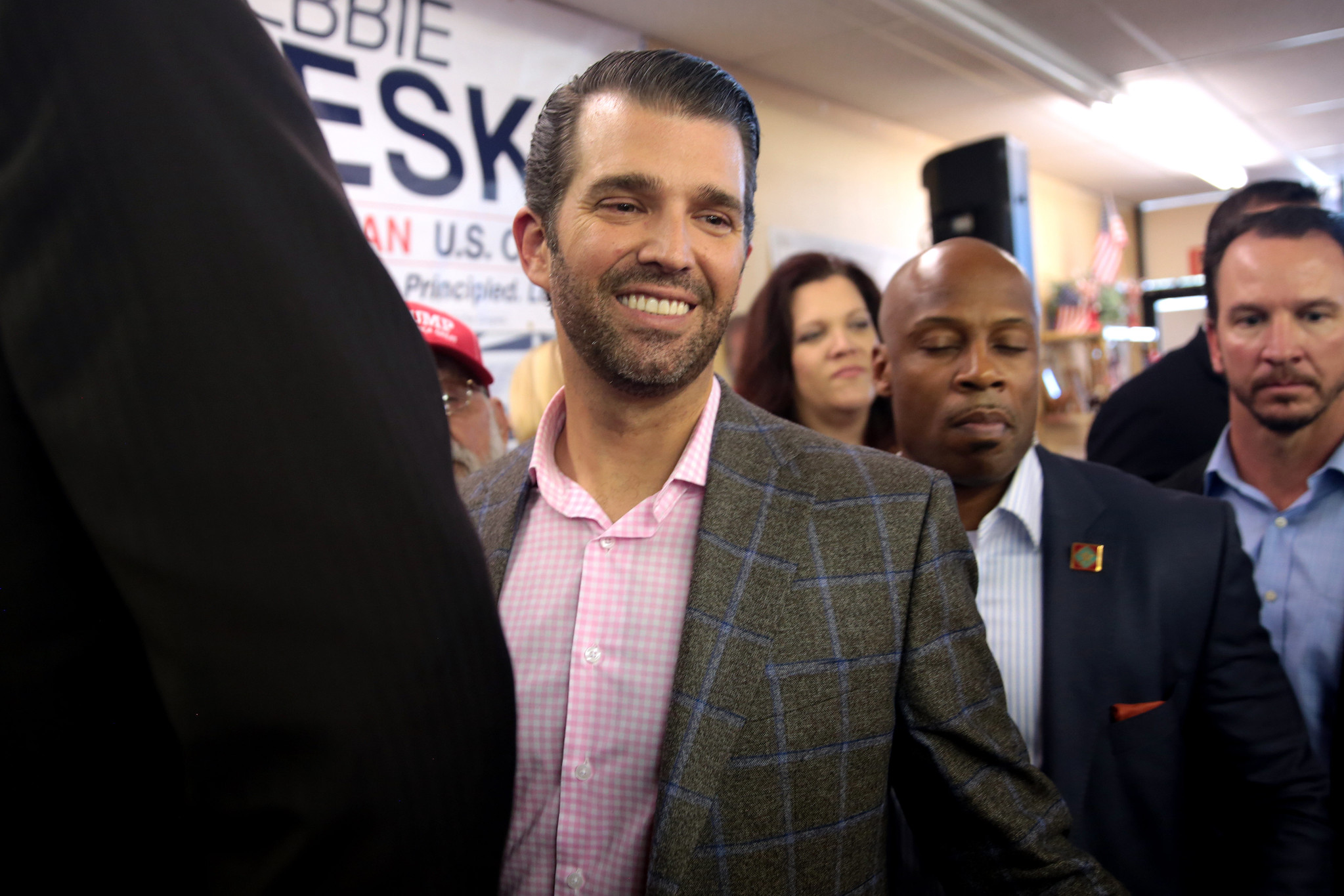

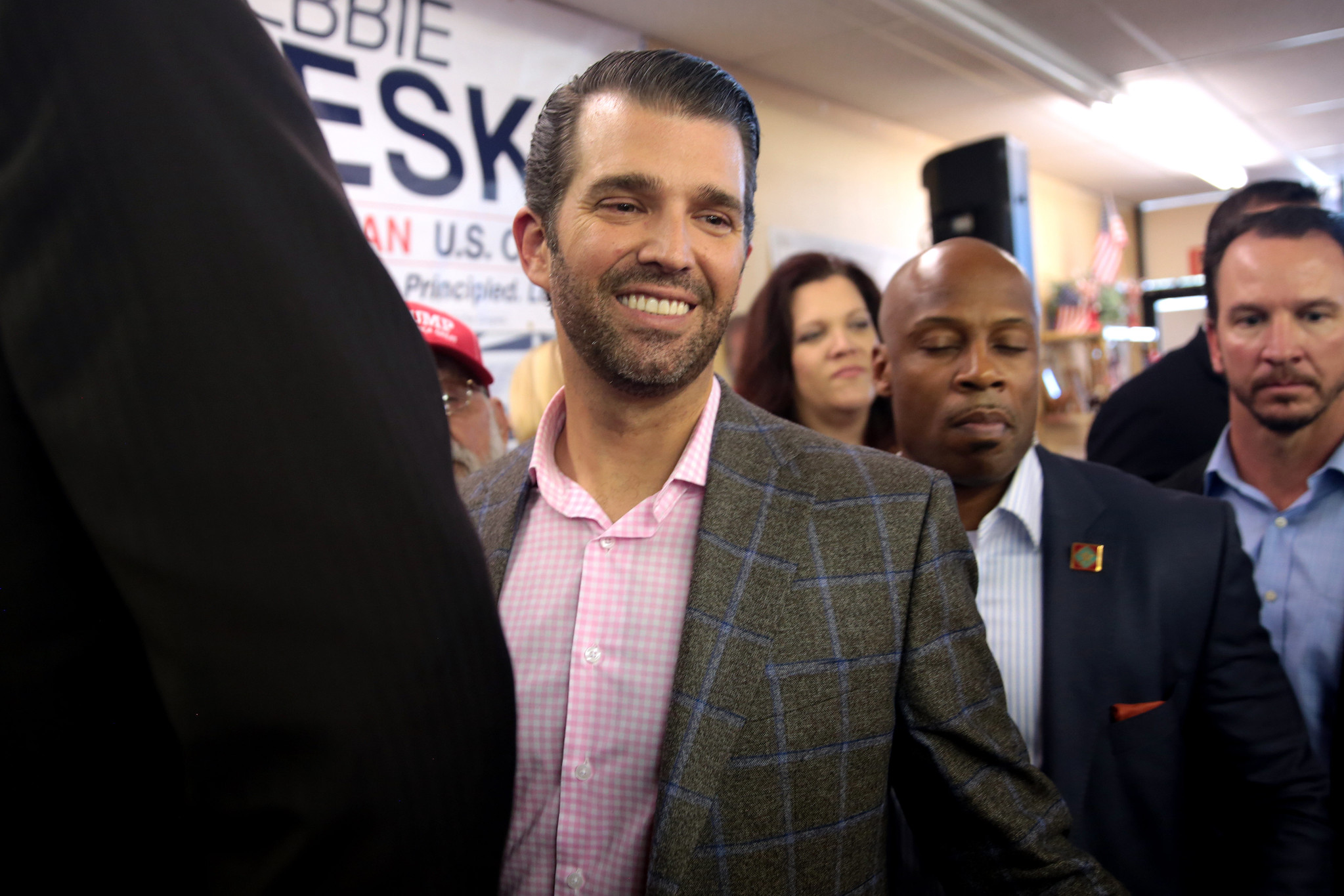

Featured2 years agoFox News Calls Security on Donald Trump Jr. at GOP Debate [Video]

-

Latest News1 year ago

Latest News1 year agoNude Woman Wields Spiked Club in Daylight Venice Beach Brawl

-

Latest News1 year ago

Latest News1 year agoSupreme Court Gift: Trump’s Trial Delayed, Election Interference Allegations Linger