Featured

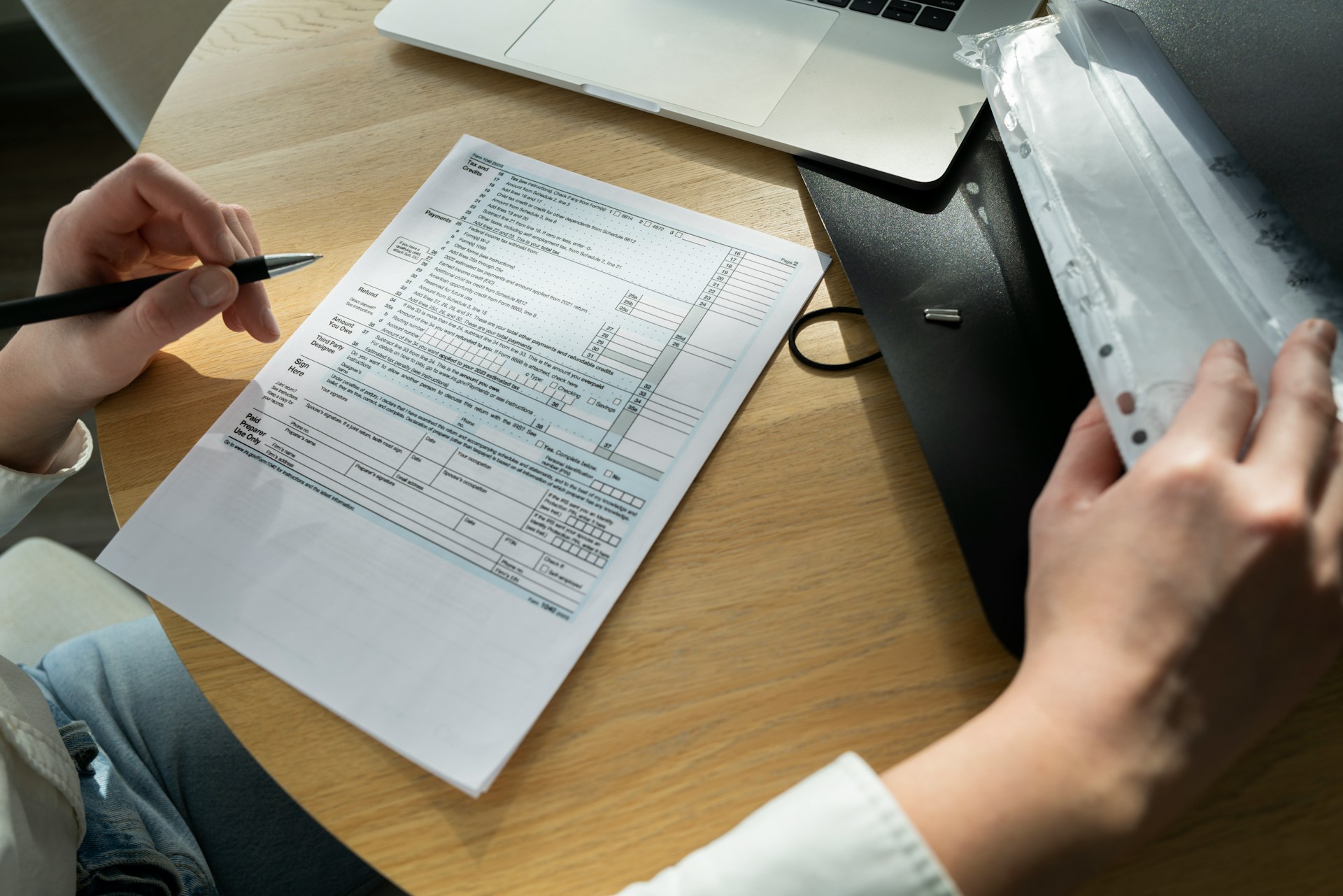

January 1, IRS Sends Surprise Payments to Eligible Taxpayers

Hey y’all, it looks like the IRS is stepping up to help folks who missed out on claiming their Recovery Rebate Credit back in 2021. They found out around one million good Americans didn’t get their money because they forgot or didn’t know how to claim it right on their taxes.

So here’s the deal: Without you having to lift a finger, the IRS is going to send out these payments automatically by the end of December. That’s right, you won’t have to mess around with filing more paperwork or dealing with government hassles.

IRS Commissioner Danny Werfel says they’re trying hard to make things better for taxpayers and get this money where it belongs. They figured out some people missed out on this credit—it was all tied up with the COVID-19 pandemic relief efforts and such.

If you left that spot blank or wrote “$0” on your 2021 tax return, but you were actually eligible, expect a payment coming your way by late January 2025. It’ll go to the bank account or address you have on your 2023 tax return.

The folks at the IRS are sending out letters to let you know if you’re getting this money. And if you changed banks, don’t sweat it—they’ll make sure your check gets to you one way or another.

There’s a max of $1,400 you could get, depending on what you qualify for, and the IRS plans to dish out around $2.4 billion in total to help folks out.

Also, heads up for those who didn’t file their 2021 taxes yet—you’ve got until April 15, 2025, to get that done if you want to snag your Recovery Rebate Credit.

Seems like the IRS is finally working in our favor for a change—let’s hope for more of that!

Wyatt Matters!

It’s great news that the IRS is helping people who missed out on their Recovery Rebate Credit from 2021. Many of us might have forgotten or didn’t know how to claim it during the pandemic. Now, they’re making it easy by sending out payments automatically, so we don’t have to worry about more paperwork or stress.

The IRS seems to really care about making things right for everyone. They’re planning to send payments to those who left their credit unclaimed, and they’re making sure the money gets to the right place. This effort shows they are working to support folks who need this financial help, and it’s nice to see government efforts making a positive impact.

People can receive up to $1,400, which can really make a difference. And if you didn’t file your 2021 taxes yet, you still have until April 2025 to claim your credit. It feels good to know that the IRS is taking steps to be on our side, especially during times when many are still feeling the effects of the pandemic. Let’s hope they keep up the good work!

As our loyal readers, we encourage you to share your thoughts and opinions on this issue. Let your voice be heard and join the discussion below.

-

Entertainment2 years ago

Entertainment2 years agoWhoopi Goldberg’s “Wildly Inappropriate” Commentary Forces “The View” into Unscheduled Commercial Break

-

Entertainment2 years ago

Entertainment2 years ago‘He’s A Pr*ck And F*cking Hates Republicans’: Megyn Kelly Goes Off on Don Lemon

-

Featured2 years ago

Featured2 years agoUS Advises Citizens to Leave This Country ASAP

-

Featured2 years ago

Featured2 years agoBenghazi Hero: Hillary Clinton is “One of the Most Disgusting Humans on Earth”

-

Entertainment2 years ago

Entertainment2 years agoComedy Mourns Legend Richard Lewis: A Heartfelt Farewell

-

Featured2 years ago

Featured2 years agoFox News Calls Security on Donald Trump Jr. at GOP Debate [Video]

-

Latest News2 years ago

Latest News2 years agoSupreme Court Gift: Trump’s Trial Delayed, Election Interference Allegations Linger

-

Latest News2 years ago

Latest News2 years agoNude Woman Wields Spiked Club in Daylight Venice Beach Brawl

AARON WATSON

December 29, 2024 at 1:34 am

WHY..WAS THE 1.400 NO MADE A OFFER TO PEOPLE LIVING ON DESABILTY..I KNOW SO MANY THAT DID NOT GET IT..AND AS AMERICANS..I THINK THEY SHOULD