Latest News

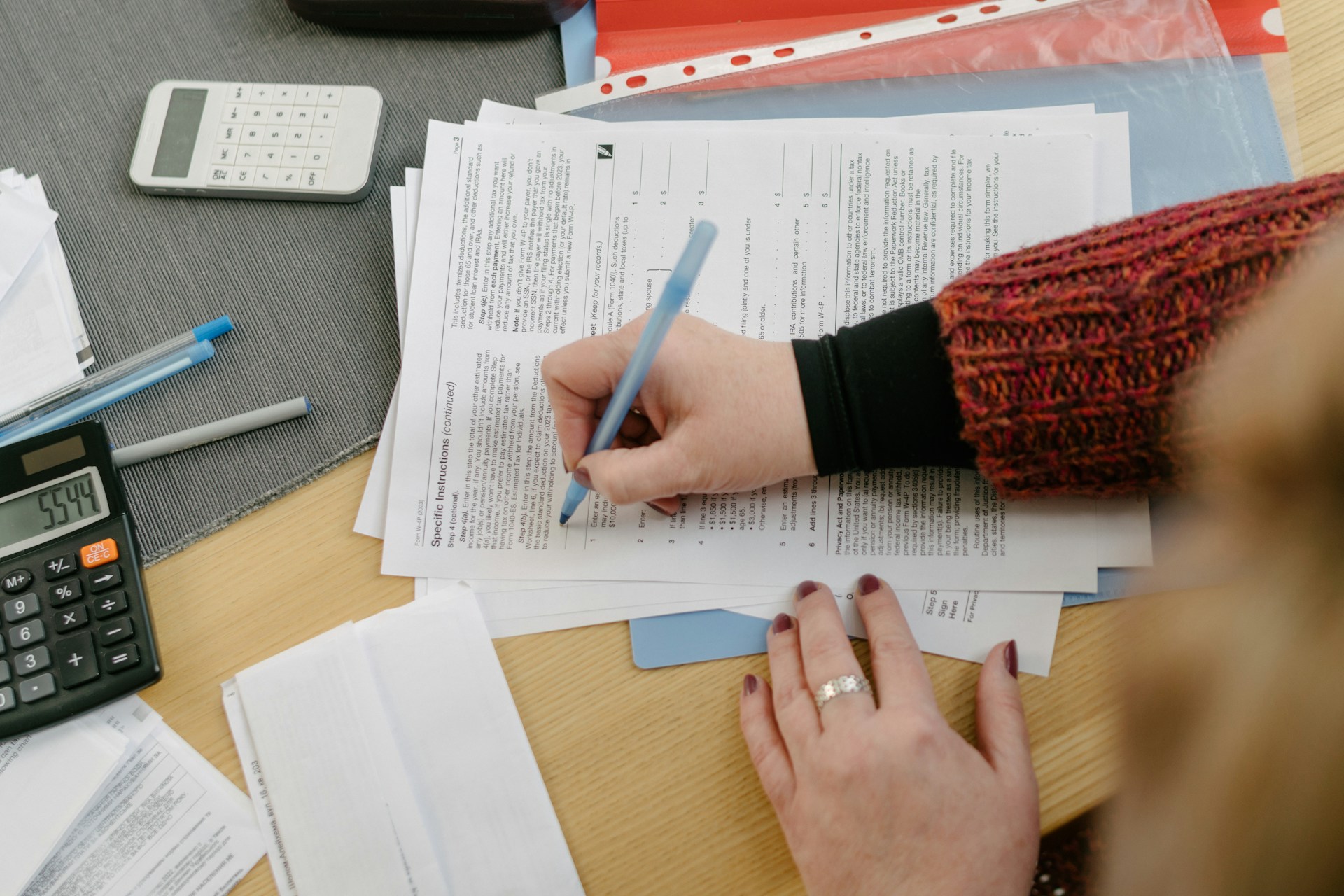

January 1, IRS Apologizes: Taxpayers Hit with Unjust Fines in Shocking Error

Nothing is quite as alarming as receiving a letter from the Internal Revenue Service (IRS) in your mailbox. These notices typically inform taxpayers of changes, corrections, or delays in their returns.

Recently, the IRS has been issuing numerous CP14 notices. These alert individuals of a balance due, even though they paid their taxes on time.

Taxpayers in Pennsylvania have received these CP14 forms. They claim that they owe thousands of dollars to the IRS by June 24, as well as penalties and interest for failing to meet the April 19 deadline.

But the twist? These taxpayers did pay their taxes.

The IRS has recognized its mistake and apologized to law-abiding taxpayers. They said, “The IRS is aware that some taxpayers are receiving CP14 (Balance Due, No Math Error) notices indicating a balance due even though payments were made with their 2023 tax return.”

This issue has affected taxpayers who paid electronically or by mail via a physical check. They might see their balance as pending even though the IRS received and processed their 2023 tax return.

The IRS explained that the notice may have been initiated before the payment was processed on the account. Or, there may have been errors in the payment that require additional handling.

If you received a CP14 form but paid your taxes in full and on time, the IRS advises you to disregard the notice. However, if you didn’t pay your 2023 taxes in full, you should follow the notice’s instructions to ensure your account is up-to-date.

The IRS encourages taxpayers to create or log into their IRS account to verify their 2023 tax return status. “Taxpayers can ensure that their payment is on their account by checking Online Account under the SSN that made the payment. Note that any assessed penalties and interest will be automatically adjusted when the payment(s) are applied correctly by the IRS,” the agency said.

While the IRS is currently researching the matter, they will provide an update as soon as possible.

As our loyal readers, we encourage you to share your thoughts and opinions on this issue. Let your voice be heard and join the discussion below.

-

Entertainment2 years ago

Entertainment2 years agoWhoopi Goldberg’s “Wildly Inappropriate” Commentary Forces “The View” into Unscheduled Commercial Break

-

Entertainment2 years ago

Entertainment2 years ago‘He’s A Pr*ck And F*cking Hates Republicans’: Megyn Kelly Goes Off on Don Lemon

-

Featured2 years ago

Featured2 years agoUS Advises Citizens to Leave This Country ASAP

-

Featured2 years ago

Featured2 years agoBenghazi Hero: Hillary Clinton is “One of the Most Disgusting Humans on Earth”

-

Entertainment2 years ago

Entertainment2 years agoComedy Mourns Legend Richard Lewis: A Heartfelt Farewell

-

Featured2 years ago

Featured2 years agoFox News Calls Security on Donald Trump Jr. at GOP Debate [Video]

-

Latest News2 years ago

Latest News2 years agoNude Woman Wields Spiked Club in Daylight Venice Beach Brawl

-

Latest News2 years ago

Latest News2 years agoSupreme Court Gift: Trump’s Trial Delayed, Election Interference Allegations Linger

Barry Gregory

June 18, 2024 at 8:54 am

Wake up.. Do you guys not understand? The IRS is now a weapon for ideological warfare, not honest tax collection. All these “mistakes” are just door openers for the 87,000 new “agents” to pursue the destruction of ideologically conservative citizens. Look at the vetting process for hiring these “agents” and you’ll see the background research involved leads to only one conclusion. These are the modern day version of the SS and they are there to weed out the opposition to their ides.

William s Thomas III

July 24, 2024 at 2:12 pm

I received three such notices it took me eight hours on the phone with IRS to finally being told I was over paid and would receive a refund.