Featured

January 1, The Highest-Paid Federal Employee: Inside Fauci’s Staggering Financial Compensation

When Dr. Anthony Fauci retires from his job as director of the National Institute of Allergy and Infectious Diseases at the National Institutes of Health, he will make at least $350,000 per year.

Fauci, 81, was eligible for retirement in 2005, but he stayed at his post, which now pays him $434,312 annually — the highest of any federal employee, including the president. The doctor out-earned the president for the second year in a row.

His staggering pension will be the largest in U.S. history. Open the Books calculated his retirement earnings at 80% of his highest three-year average plus cost of living increases.

Fauci recently told ABC’s Jonathan Karl he has no plans to retire.

“There’s no way I’m going to walk away from this until we get this under control. I mean, that’s the purpose of what we do. That’s our mission in life. In the middle of it, I’m not going to walk away,” Fauci said. “It’s kind of like we’re halfway through World War II and you decide, ‘Well, I think I’ve had enough of this. I’m walking away.'”

Fauci’s inevitable retirement earnings are a sharp contrast to the 1 in 4 Americans who have no retirement savings. According to Yahoo News, the median retirement balance for people ages 55 to 64 is $120,000, which would only yield $1,000 a month in their retirement years.

Source:

-

Entertainment2 years ago

Entertainment2 years agoWhoopi Goldberg’s “Wildly Inappropriate” Commentary Forces “The View” into Unscheduled Commercial Break

-

Entertainment2 years ago

Entertainment2 years ago‘He’s A Pr*ck And F*cking Hates Republicans’: Megyn Kelly Goes Off on Don Lemon

-

Featured2 years ago

Featured2 years agoUS Advises Citizens to Leave This Country ASAP

-

Featured2 years ago

Featured2 years agoBenghazi Hero: Hillary Clinton is “One of the Most Disgusting Humans on Earth”

-

Entertainment2 years ago

Entertainment2 years agoComedy Mourns Legend Richard Lewis: A Heartfelt Farewell

-

Featured2 years ago

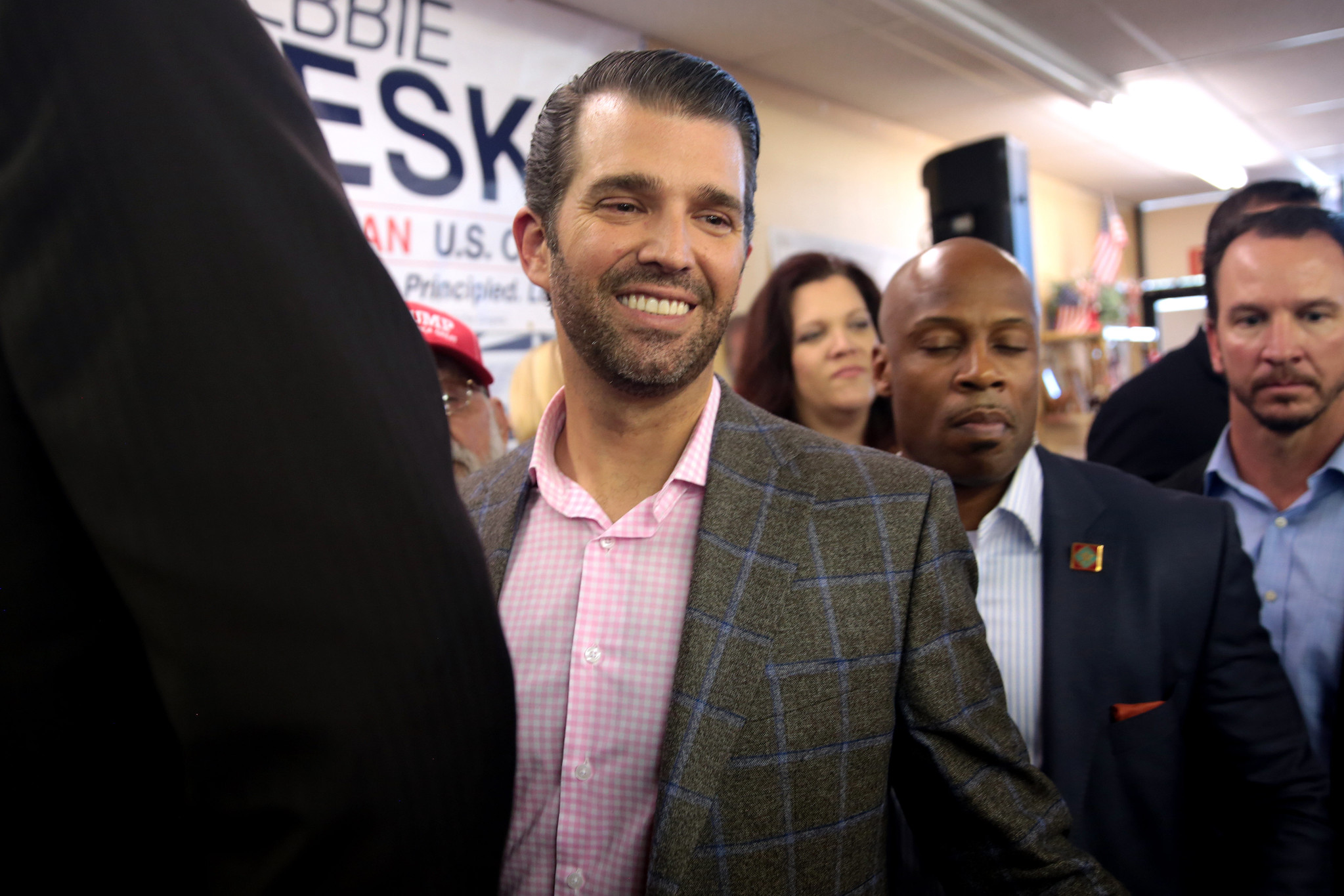

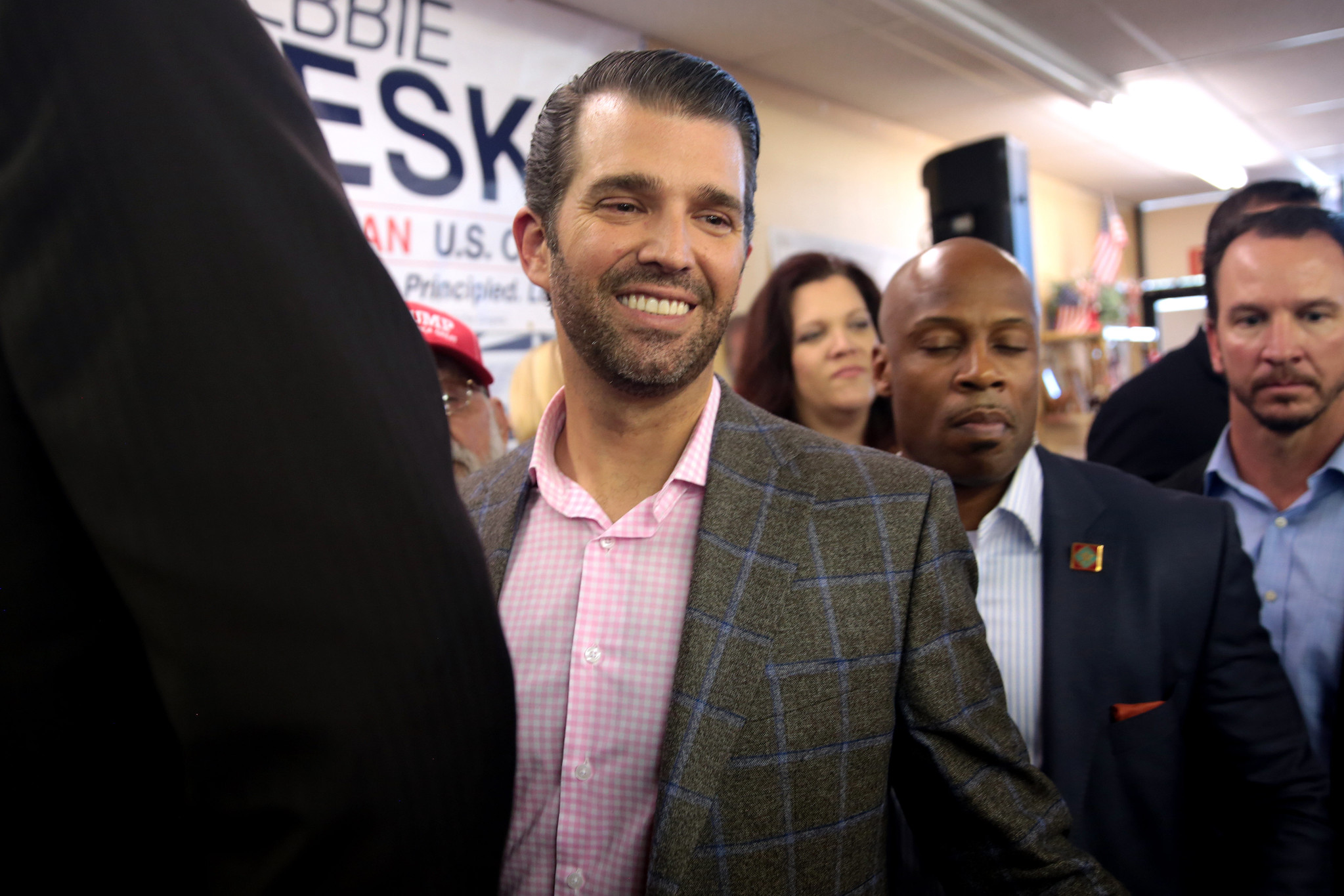

Featured2 years agoFox News Calls Security on Donald Trump Jr. at GOP Debate [Video]

-

Latest News2 years ago

Latest News2 years agoNude Woman Wields Spiked Club in Daylight Venice Beach Brawl

-

Latest News2 years ago

Latest News2 years agoSupreme Court Gift: Trump’s Trial Delayed, Election Interference Allegations Linger

2004done

January 3, 2022 at 11:57 am

Quite an accomplishment, an MD without patients; a virologist that assisted in spreading HIV, SARS, CCPVID-19; and highest-paid government employee without any ‘boss,’ and magnetically attracted to cameras (especially when he has nothing that helps anyone, including himself, to understand, accurately explain, and/or effectively combat a virus. Why would this prime example of the PETER-PRINCIPLE retire?

gunnygil

January 3, 2022 at 4:42 pm

And he only pays Social Security tax on the first $139,000 of that income. Social Security tax base has to be raised to $500,000 minimum especially to include all income of federally paid by tax dollar employees

Robert Neveux

January 3, 2022 at 5:34 pm

All I can say is, WHY???