Finance

January 1, Countries With the Highest and Lowest Marginal Income Tax Rates

It’s that time again when people in many countries have to do those dreaded taxes. Let’s talk about how different countries handle taxes on income.

Visual Capitalist’s Pallavi Rao checked out almost 150 different countries to see how much they tax the highest earners. They used data from PwC’s Worldwide Tax Summaries.

Now, let’s remember, this only tells us about the taxes on the richest folks’ money. This doesn’t cover things like property or sales taxes or taxes you pay to your state or city.

Guess what? Western European countries have the highest income taxes. In fact, seven countries have top rates over 50%, and six of them are in Europe. Denmark leads the pack with a whopping 55.9%.

Over there in Denmark, besides the regular taxes, workers have to pay something called a labor market tax. That sure adds up! They also have specific taxes on money made from shares and dividends.

Here in the U.S., the highest tax rate is 37%, and you only pay that if you make more than $609,000 a year. But remember, states have their taxes too.

The money from high taxes often goes to government services like healthcare and education. Some say that helps balance out income gaps by supporting folks with less money.

But let’s be real, when people have less money to spend because of taxes, they might spend less on shopping and such. And, really talented people might move away to places with lower taxes, taking their talents elsewhere.

Some smart folks even find ways to avoid these high taxes by using countries with lower taxes. If you’re curious, there’s a list of the top 10 tax havens to check out where people hide their money.

Now, some people might say high taxes are necessary for public services, but others feel it could stifle personal freedom and economic growth. It’s a big debate, and it’s worth keeping an eye on!

Wyatt Matters!

Many countries have different ways of taxing the money people earn, and some places tax the richest people a lot more than others. In Western Europe, for example, income taxes are quite high, with Denmark topping the list at 55.9%. They even have extra taxes for things like money made from investments. These high taxes are supposed to help pay for important things like healthcare and education, which can help people who have less money. But paying so much in taxes can be frustrating, and some think it might even cause talented people to move to places where taxes are lower.

In the United States, the top income tax rate is 37% for those who make over $609,000 a year. But remember, each state has its own taxes too. Even though this is lower than the rates in many European countries, it still raises the question of whether high taxes are worth it. People often argue that the money is used for good purposes, like public services, which can help make life better for everyone. However, some people worry that high taxes might discourage spending and make people want to find ways to pay less, including moving to places with lower taxes.

It’s a tough balancing act. High taxes can help provide important services to all, but they can also limit what people can do with their own money. There’s an ongoing debate about whether taxes should be higher to support public needs or lower to encourage personal freedom and economic growth. Watching how different countries handle this can teach us a lot about the best way to manage these financial challenges.

As our loyal readers, we encourage you to share your thoughts and opinions on this issue. Let your voice be heard and join the discussion below.

-

Entertainment2 years ago

Entertainment2 years agoWhoopi Goldberg’s “Wildly Inappropriate” Commentary Forces “The View” into Unscheduled Commercial Break

-

Entertainment2 years ago

Entertainment2 years ago‘He’s A Pr*ck And F*cking Hates Republicans’: Megyn Kelly Goes Off on Don Lemon

-

Featured2 years ago

Featured2 years agoUS Advises Citizens to Leave This Country ASAP

-

Featured2 years ago

Featured2 years agoBenghazi Hero: Hillary Clinton is “One of the Most Disgusting Humans on Earth”

-

Entertainment2 years ago

Entertainment2 years agoComedy Mourns Legend Richard Lewis: A Heartfelt Farewell

-

Featured2 years ago

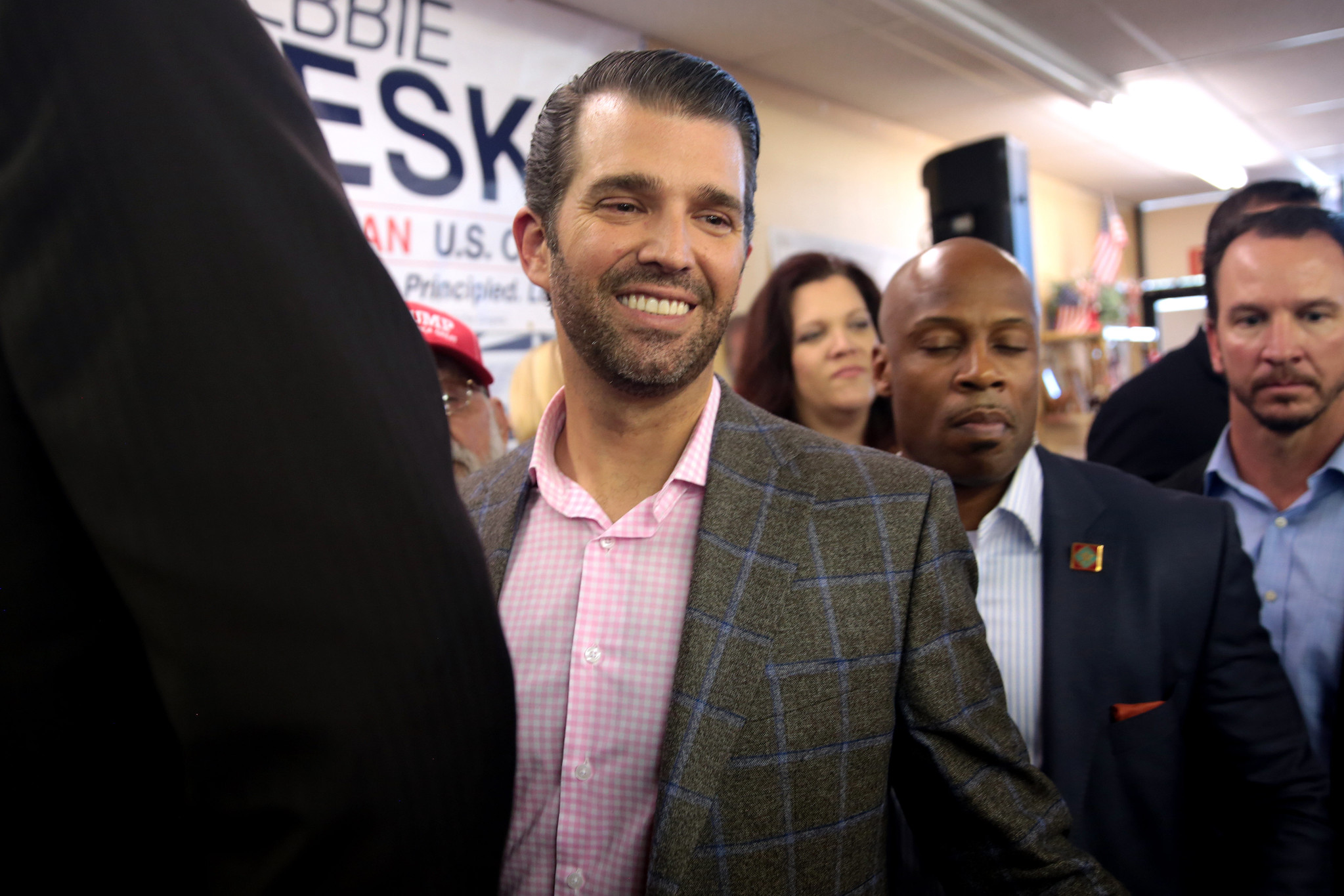

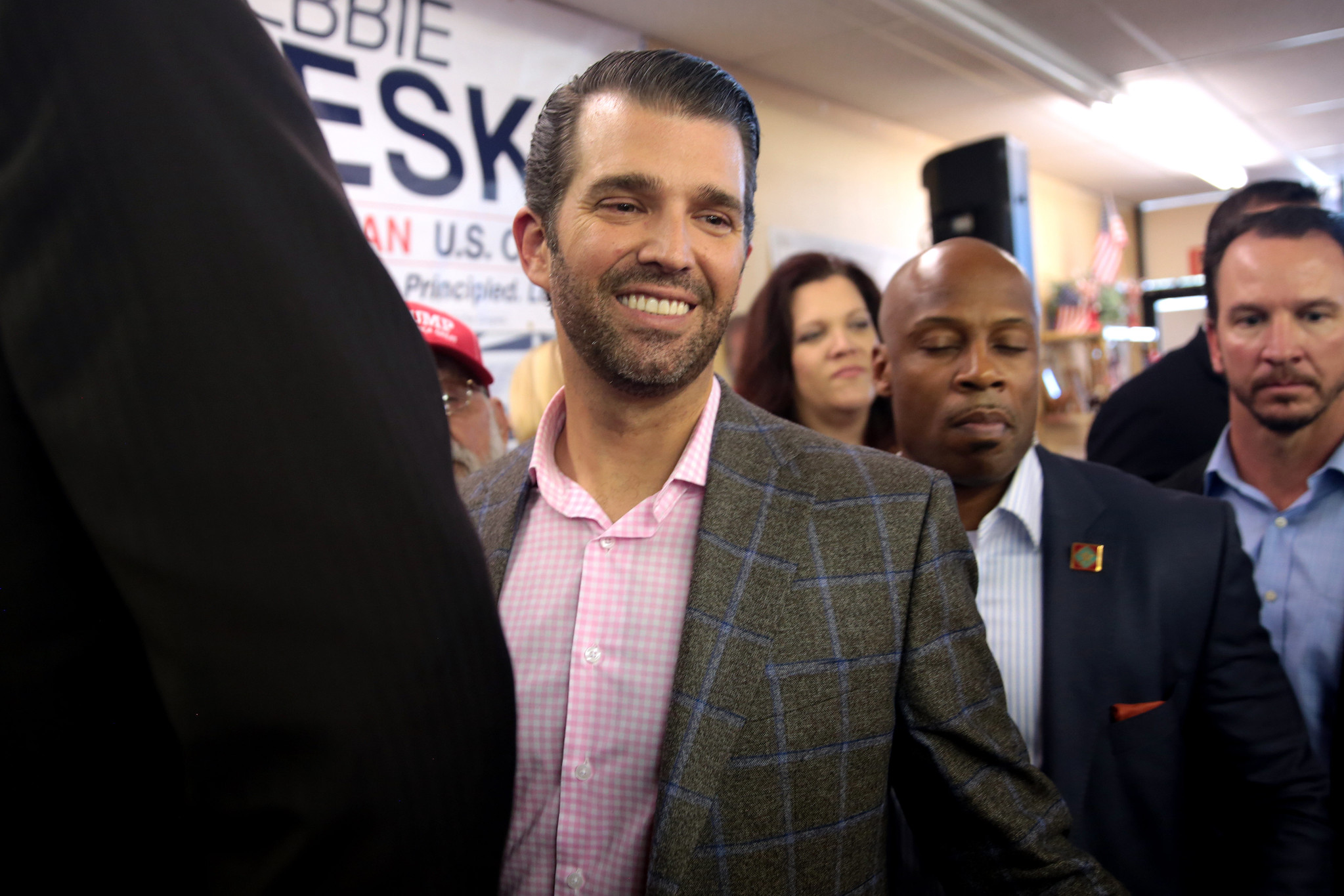

Featured2 years agoFox News Calls Security on Donald Trump Jr. at GOP Debate [Video]

-

Latest News2 years ago

Latest News2 years agoNude Woman Wields Spiked Club in Daylight Venice Beach Brawl

-

Latest News2 years ago

Latest News2 years agoSupreme Court Gift: Trump’s Trial Delayed, Election Interference Allegations Linger