Featured

January 1, New IRS Rule Could “Shock” Millions of Americans

Financial experts say that Americans who earned income online this year could be in for a major shock when they file their taxes in 2023.

Starting next year, the IRS will require taxpayers to report transactions of at least $600 that are received through apps like Venmo, PayPal, and Cash App.

Previously, the third-party payment processors were only required to report a user’s business transactions to the IRS if they exceeded $20,000 or they had 200 separate transactions throughout the year.

Now, the apps must send users a Form 1099-K if their transactions total at least $600 for the calendar year.

Financial experts believe this will be a “shock” to taxpayers.

“I think it will come as a shock out of nowhere that people are getting these,” said Nancy Dollar, a tax lawyer at Hanson Bridgett.

The change comes as part of the American Rescue Plan, passed by Democrats — without any Republican votes — in March 2021. The adjustment is meant to mitigate tax evasion, but critics say the move is a textbook example of government overreach that could end up hurting small businesses.

Data from the Pew Research Center shows that about one in four Americans earns extra money online — whether it’s selling something, renting their home through sites like AirBNB, etc.

But now, Dollar believes that the change could ultimately discourage Americans from participating in the so-called gig economy.

“Everyone I know offloads old goods that they have on these platforms because it’s so easy,” Dollar said. “Or they’ve been engaging in gig work on a very casual basis, and that affects gig workers as well who have been underreporting their income. I think it’s going to force people to either cut down on those activities or kind of take them more seriously and track them.”

The new rule doesn’t apply to transactions like sending your loved one a gift via Venmo or PayPal, paying your friend back for dinner, or sending your roommate rent money.

“This doesn’t include things like paying your family or friends back using PayPal or Venmo for dinner, gifts, shared trips,” PayPal previously said in a statement.

To clarify, business owners have always been required to report online income to the IRS. The new rule means that the IRS will be aware of money earned by business owners on the third-party payment apps — regardless of what the taxpayer actually reports on their 1099-K.

“For the 2022 tax year, you should consider the amounts shown on your Form 1099-K when calculating gross receipts for your income tax return,” PayPal said. “The IRS will be able to cross-reference both our report and yours.”

The payment apps may request additional information from users, such as their Employer Identification Number (EIN), Individual Tax Identification Number (ITIN), or Social Security Number (SSN).

Source: Fox Business | Internal Revenue Service

-

Entertainment2 years ago

Entertainment2 years agoWhoopi Goldberg’s “Wildly Inappropriate” Commentary Forces “The View” into Unscheduled Commercial Break

-

Entertainment2 years ago

Entertainment2 years ago‘He’s A Pr*ck And F*cking Hates Republicans’: Megyn Kelly Goes Off on Don Lemon

-

Featured2 years ago

Featured2 years agoUS Advises Citizens to Leave This Country ASAP

-

Featured2 years ago

Featured2 years agoBenghazi Hero: Hillary Clinton is “One of the Most Disgusting Humans on Earth”

-

Entertainment1 year ago

Entertainment1 year agoComedy Mourns Legend Richard Lewis: A Heartfelt Farewell

-

Featured2 years ago

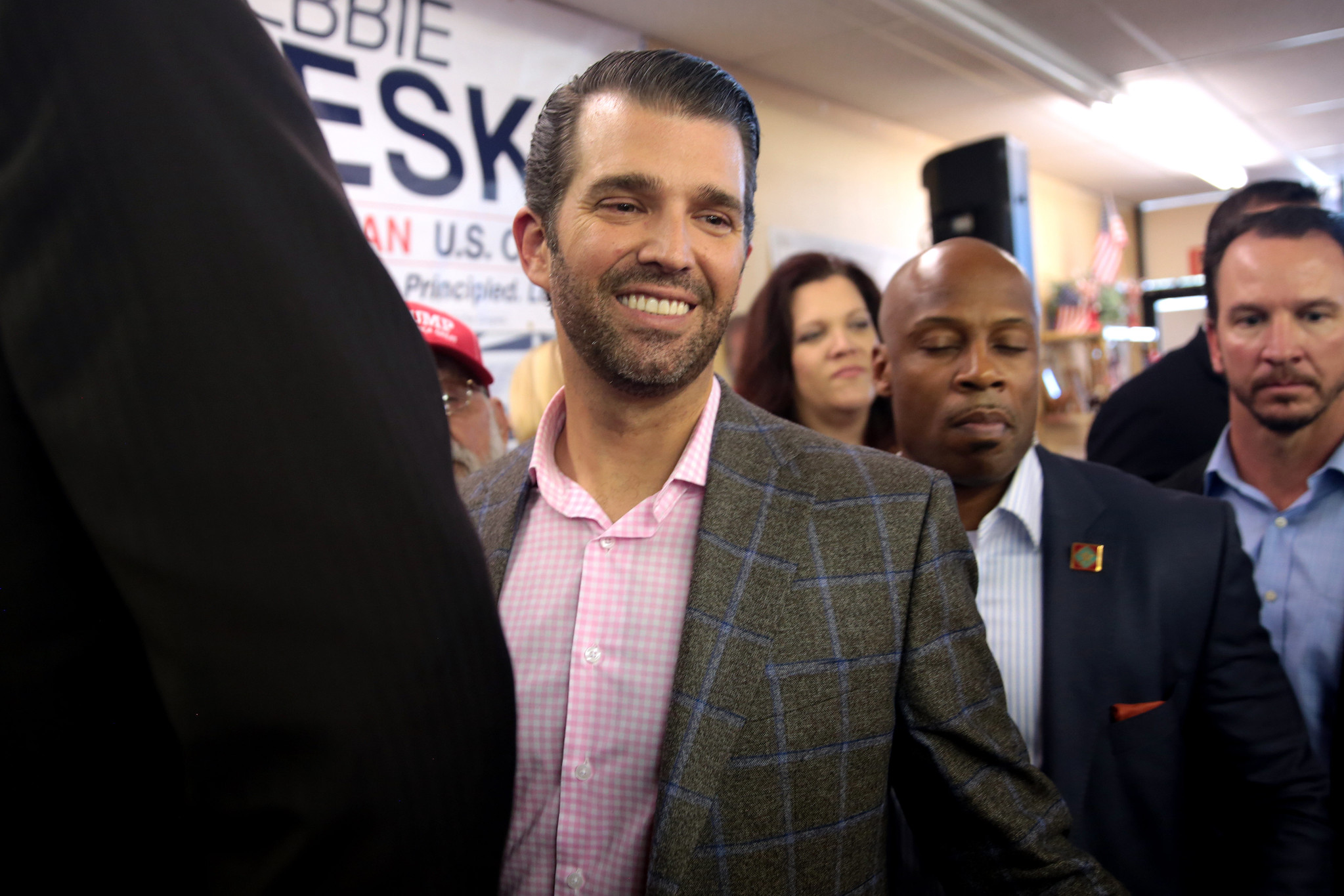

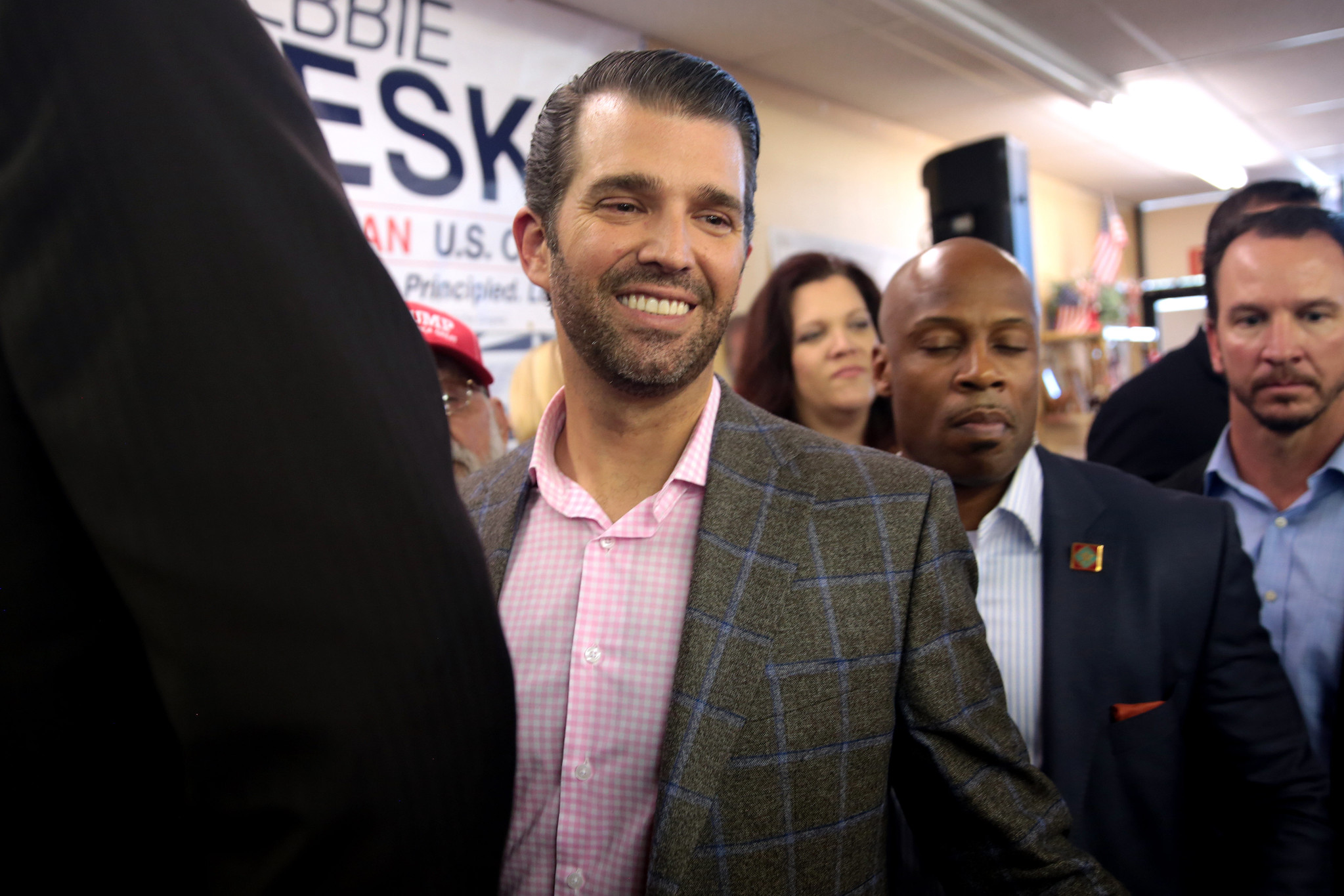

Featured2 years agoFox News Calls Security on Donald Trump Jr. at GOP Debate [Video]

-

Latest News1 year ago

Latest News1 year agoNude Woman Wields Spiked Club in Daylight Venice Beach Brawl

-

Latest News1 year ago

Latest News1 year agoSupreme Court Gift: Trump’s Trial Delayed, Election Interference Allegations Linger

DiYi

December 16, 2022 at 7:15 pm

Yep, we hired 87,000 armed IRS Agents to go after the billionaires.

John Babbs

December 16, 2022 at 7:40 pm

I think biden should pay his taxes first ,he owes over $500,000. With his shady deals with his criminal sons,bet they owe taxes also

Rattlerjake

December 17, 2022 at 12:54 am

There are so many STUUUUUUUUUUUUUUPID people in this country, like you, that still don’t know that the entire income tax system is a scam. These politicians and most multi-millionires/billionaires know the truth – that’s why they don’t pay taxes. https://www.youtube.com/watch?v=66ZK0p21re0. It’s time for you fools to wake up and fight back rather than continuing to go along with this fraud. WAKE THE F*CK UP!!!!!

Tim

December 17, 2022 at 1:24 pm

after 160 years of socialism in Amerika (democracy=MOB RULE) only a fool would be “shocked” at yet another form of ONGOING abuse we have been suffering under. Why wouldn’t any state want to separate from this theft? one reason FEAR. Fear is the passion of slaves. Brave men, since on this earth, have refused to be slaves to others. Only the cowards were conquered and enslaved. In Amerika you are “told” you are free, by your masters, and you believe them. This use to be called insanity.

Rachel

December 17, 2022 at 6:39 am

I already report the income from eBay on my Schedule C on my Income Tax for years. Now I do not know how to report them.

Fred Ward

December 30, 2022 at 7:31 am

Cash, while it still exists.

Jim

December 30, 2022 at 10:43 am

Most people will revert to cash transactions, just like drug dealers do to avoid the new tax rule. That’s one reason Globalists and bureaucrats are pushing for ‘digital currency’ so they can track and control all transactions. Power and control, nothing has changed. Don’t rule out the barter system of commerce. It’s been around since the first caveman traded his club for a new mate.