Featured

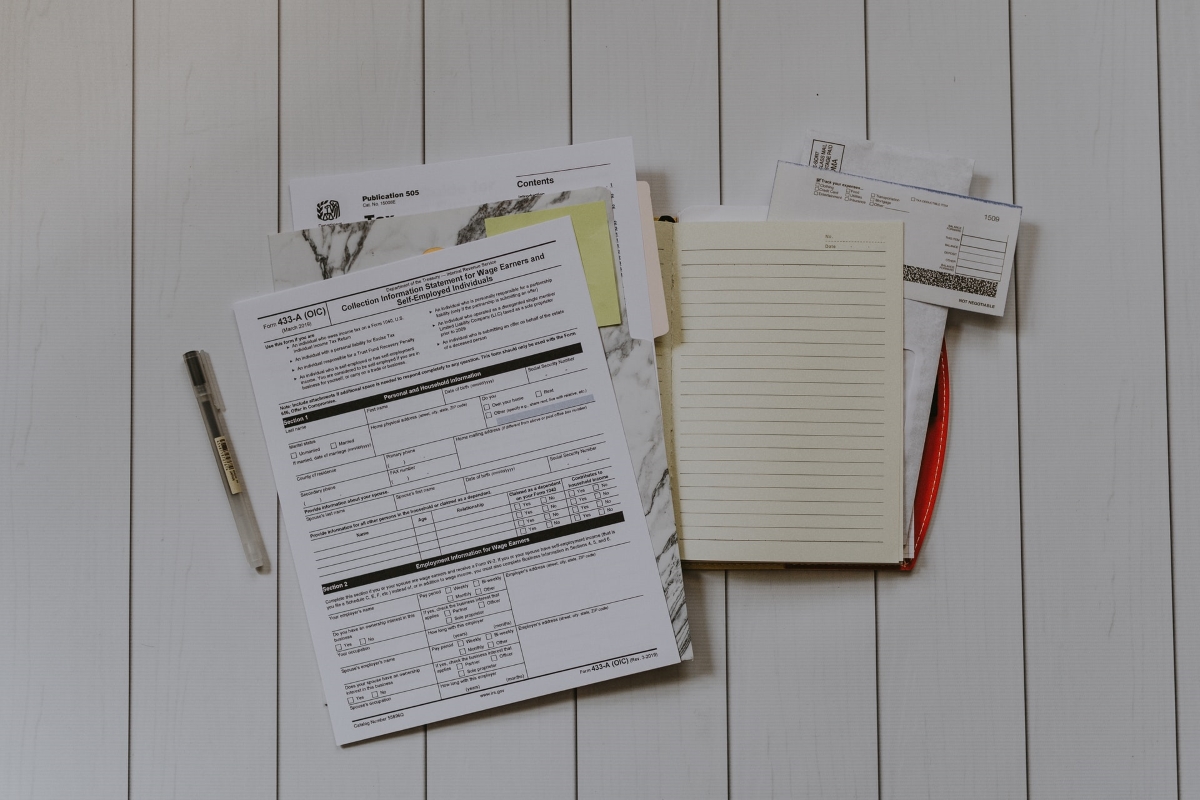

January 1, IRS Unveils Major Change for Tax Filers in 2023

ON THIS DAY IN HISTORY…

1944: World War II – U.S. troops capture Aachen, 1st large German city to fall.

The Internal Revenue Service announced inflation-related adjustments for the 2023 tax year, enabling Americans to keep more of their hard-earned money.

The move is a welcome change as sky-high inflation continues to pummel the nation. The IRS adjustments apply to the 2023 tax year, for which tax returns will generally be filed in 2024.

According to The Hill, the adjustments will ward off “bracket creep” — which is when wage hikes aimed at mitigating a higher cost of living end up putting taxpayers into higher tax brackets.

For the 2023 tax year, the standard deduction for married couples filing jointly $27,700 — up $1,800 from 2022. For single filers and married taxpayers filing separately, the standard deduction is $13,850 — a $900 increase.

According to the IRS, the income thresholds for tax brackets are among the changes “of greatest interest to most taxpayers.”

While the tax rates weren’t adjusted, the salary cutoffs have changed.

The top rate, 37%, applies to single taxpayers with income over $578,125 — up from $539,900 — and married couples filing jointly over $693,750 — up from $647,850.

Conversely, the bottom rate of 10% applies to single taxpayers with income $11,000 or less — up from $10,275 — and married couples filing jointly with income $22,000 or less — up from $20,550.

-

Entertainment2 years ago

Entertainment2 years agoWhoopi Goldberg’s “Wildly Inappropriate” Commentary Forces “The View” into Unscheduled Commercial Break

-

Entertainment2 years ago

Entertainment2 years ago‘He’s A Pr*ck And F*cking Hates Republicans’: Megyn Kelly Goes Off on Don Lemon

-

Featured2 years ago

Featured2 years agoUS Advises Citizens to Leave This Country ASAP

-

Featured2 years ago

Featured2 years agoBenghazi Hero: Hillary Clinton is “One of the Most Disgusting Humans on Earth”

-

Entertainment2 years ago

Entertainment2 years agoComedy Mourns Legend Richard Lewis: A Heartfelt Farewell

-

Featured2 years ago

Featured2 years agoFox News Calls Security on Donald Trump Jr. at GOP Debate [Video]

-

Latest News2 years ago

Latest News2 years agoSupreme Court Gift: Trump’s Trial Delayed, Election Interference Allegations Linger

-

Latest News2 years ago

Latest News2 years agoNude Woman Wields Spiked Club in Daylight Venice Beach Brawl

Don

October 21, 2022 at 8:42 am

An attempt at vote buying by the Demonrats.

Ronald Ellsworth

October 21, 2022 at 8:52 pm

Explain.

B. Clinton

October 22, 2022 at 4:18 pm

No Need!! The Dems vote as many times as they can

Old Mort

October 21, 2022 at 9:53 am

They always find a way to make bumps in SS payments every year we get one. It seems last year was not an exception. The amount we got a raise on was eaten up by the raise in our medicare payments. When I first started collecting SS the medicare amount we paid each month was about a $100. Last year they raised it up to about $170. They can make any excuse they want (like a new Alzheimers study or medicine) I have and so do others I talk with believe they need that extra money to help pay for all the illegals health care. Biden was always a anti SS senator and he is doing everything he can while president to make us feel like SS is a government handout. He’s the worst president I have had in my 80 plus years. Anyone who votes for a democrat or RINO this year has to be out of their mind.

Helen Sanders

October 21, 2022 at 12:50 pm

You are so right.

Helen Sanders

October 21, 2022 at 12:49 pm

This percentages are all wrong. We give 10% to GOD. The government is not better than God. The percentage for all taxes should be 10% and not one percent higher.

All we need to do is lower the pay of those in the Congress and Senate. These positions were never meant to be full-time positions. They should only get paid for the days that are needed in office and that rate should be $50 per day and they get nothing when they are out of office. When their time is up in Congress and Senate they go back to their regular job. They are making WAY TO MUCH MONEY.

Ronald Ellsworth

October 21, 2022 at 8:55 pm

U may give 10%. I don’t.